In Part 1 and Part 2 of our blog series, we explored the essential setup steps required to streamline Accounts Payable (AP) operations in Oracle Financials. Now, in Part 3, we will focus on managing payment options and configuring the Business Unit (BU) for invoice and Payment processing.

A well-structured AP setup ensures efficient cash flow management, compliance, and accurate financial reporting. In this blog, we will cover key AP payment configurations, including payment terms, Rapid Data Services (RDS), distribution sets, and payment methods. At the end of this guide, your Oracle Financials system will be optimized for seamless invoice processing and payments. So, let’s begin.

Step 1: Manage Payment Options and miscellaneous setups to make the BU ready for Invoices & Payments.

Payment accounting and overrides in Oracle Financials

Proper configuration of payment accounting and overrides ensures flexibility, compliance, and accurate financial tracking in Oracle Financials. Below are key setup options and their impact on payment processing and accounting.

A. Allow Payment Date Before System Date: If set as YES, it will allow users to make backdated payments.

B. Allow Override of Supplier Site Bank Account: Enables users to change supplier bank details at the time of payment. It is more relevant for EFT, Wire Transfer and has less impact on check payments.

C. Allow Payee Override for Third-Party Payments: Enables selection of a different payee for suppliers linked under ‘Third Party Payment Relationship’ in the Supplier Site Setup. It provides flexibility in handling third-party payments directly during transaction processing.

D. Account for Payment Options

1) At Payment Issue – The accounting entry is created only when the payment is issued (not during reconciliation).

Accounting Entry:

Liability Account DR

To Cash Account

2) At Payment Clearing – No accounting entry is made at the time of payment creation. The transaction is accounted only when cash payment is made or reconciled.

Accounting Entry at Payment Clearing:

Liability Account DR

To Cash Account

3) At Payment Issue & Clearing – Accounting entries occur both at payment creation and at bank reconciliation.

Accounting Entry at Payment Creation:

Liability Account DR

To Cash Clearing Account

Account Entry at Bank Reconciliation:

Cash Clearing Account DR

To Cash Account

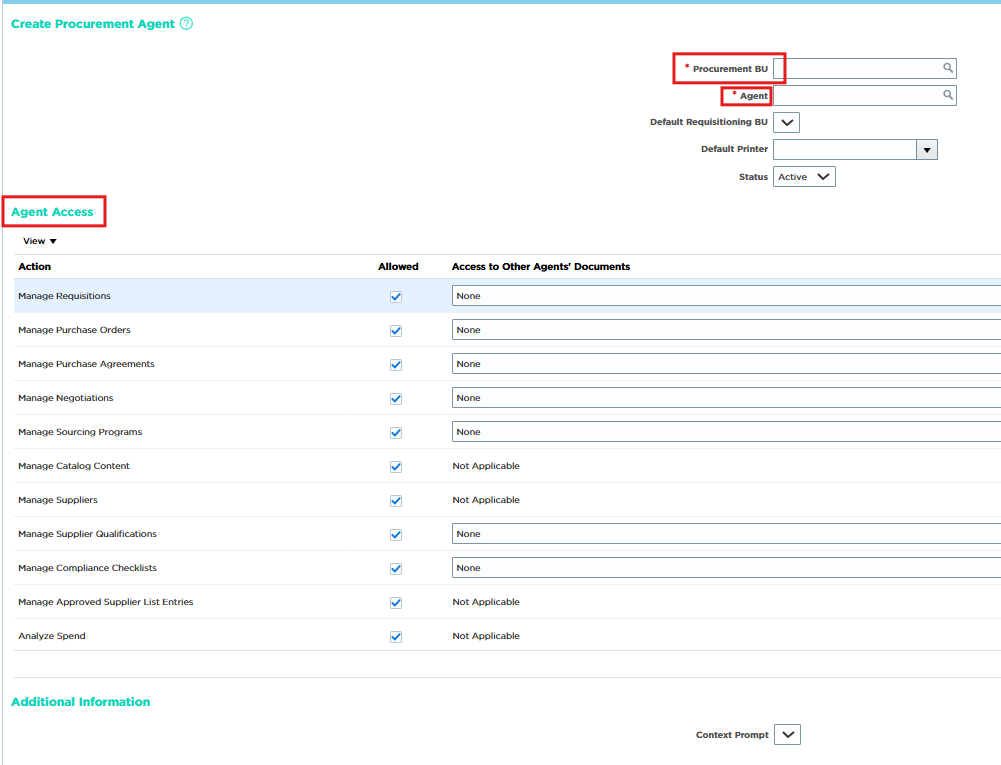

Step 2: Manage Procurement Agent

To ensure controlled access to procurement functions, organizations must designate Employee Users as Procurement Agents for a newly defined Business Unit (BU). These agents are granted the authority to create or edit supplier sites, purchase orders, and other procurement documents within the assigned BU. This setup acts as an additional security layer beyond standard role-based access, ensuring that only authorized personnel can manage procurement activities.

Users can navigate to Setup and Maintenance → Payables → Manage Procurement Agent to assign or modify procurement agents.

If a user is already defined as an Employee User, they can be selected as a Procurement Agent with all default permissions enabled. However, if the testing user is set up as an Implementation User, another Employee User must be designated as the Procurement Agent. In real-world scenarios, clients provide input on which users should have procurement access for specific BUs, ensuring structured and compliant procurement operations.

Since this is a newly created Business Unit (BU), it is essential to grant data access to specific users assigned to Accounts Payable (AP) roles. This ensures that authorized users can create invoices and process payments within the designated BU.

To configure this, navigate to:

Setup and Maintenance → Users and Security → Manage Data Access to Users, then assign the appropriate access to the required users.

Step 3: Manage Payment terms

Payment terms define the due dates and credit periods for supplier payments, ensuring accurate and timely processing of invoices. The Term Date is selected in Manage Invoice Options or at the Supplier Site level, and the Due Date is calculated as:

Due Date = Term Date + Credit Days (as per the selected Payment Term on the invoice).

To configure or modify payment terms, navigate to:

Setup and Maintenance → Financials → Payables → Manage Payment Terms.

Defining Payment Terms

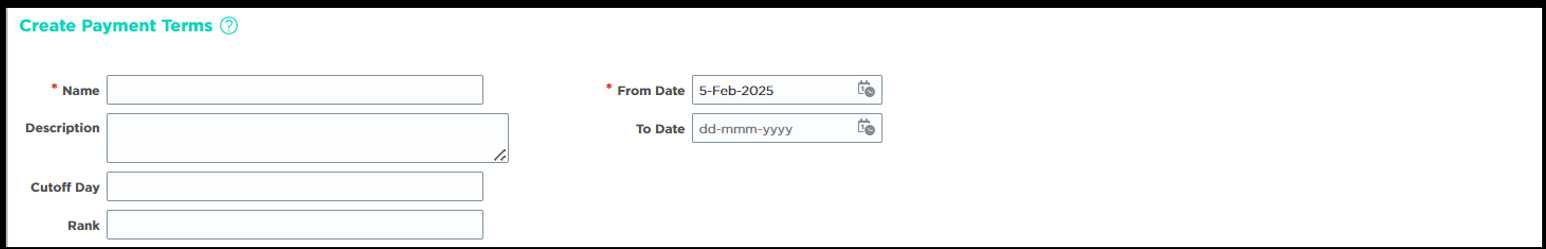

1. Header: The Header section of a Payment Term captures essential details that define its applicability and purpose. It includes:

Name – The unique identifier for the payment term.

Description – A brief explanation of the payment conditions.

From Date – The start date from which the payment term becomes active.

To Date – The end date until which the payment term remains valid.

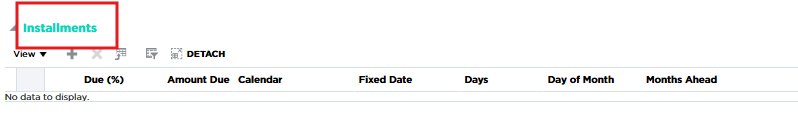

2. Installments: This section determines how payments are structured for an invoice. It includes:

Due (%): Specifies the percentage of the total invoice amount due in each installment.

Amount due: Defines the maximum limit of the payable amount for a particular installment.

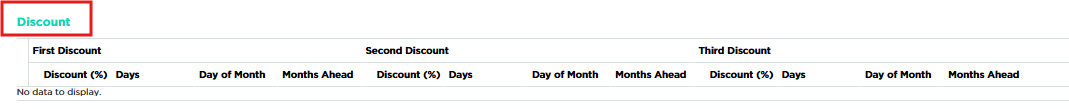

3. Discount: The Discount section is optional and applies when a payment term offers early payment discounts. It allows users to define up to three discount percentages for different early payment scenarios. The key components include:

Discount (%): The percentage discount applied when an invoice is paid early.

Days: The number of days within which the payment must be made to qualify for the discount.

Day of month: Specifies the date from which the discount period will be calculated.

For payment terms based on ‘Day of Month’ and ‘Month Ahead’, if the Due Date falls in the same month as the Term Date (Month Ahead = 0), a logical anomaly may occur where the Due Date is earlier than the Invoice Date or Term Date. To prevent this, the Cutoff Day field in the Payment Term Header ensures proper calculation of due dates and discount eligibility.

Step 4: Setting Reference Data Sets (RDS)

Reference Data Sets (RDS) are used to restrict payment terms to specific Business Units (BUs), ensuring controlled access and compliance. When a payment term is assigned to an RDS, it can only be used in BUs that share the same RDS assignment under the ‘Manage Business Unit Set Assignments’ setup task. This enhances data security and standardization across financial operations.

RDS is a new concept introduced by Oracle, replacing the traditional E-Business Suite approach. It allows organizations to group multiple BUs or Asset Books and assign them to various setup objects (e.g., Payment Terms, Depreciation Methods), restricting their use to specific entities.

To ensure transactional data security, BUs are created and assigned specific data access to authorized users. This ensures that users can only access relevant invoices, supplier sites, or financial records within their designated group companies or divisions, reinforcing role-based security in Oracle Financials.

Also Read: Streamlining AP Operations: Essential Setup Steps in Oracle Financials (Part 2)

Setup Tasks Involved in Reference Data Set (RDS) Configuration

To configure Reference Data Sets (RDS) and ensure their correct assignment to Business Units (BUs), the following setup tasks are required:

- Manage Business Units – Used to create a new RDS and assign it as the default RDS for a Business Unit.

- Manage Reference Data Sets – Allows users to define and maintain RDS configurations.

- Manage Business Unit Set Assignment – Establishes a link between a setup object, a specific Business Unit, and the assigned RDS Seed to control access.

- Individual Setup Tasks – Any setup task related to a specific setup object (e.g., Payment Terms, Depreciation Methods) that requires RDS-based security.

These configurations ensure controlled access to financial setup objects and maintain data consistency across multiple Business Units in Oracle Financials.

Step 5: Configuring Payment Methods

1. Bank-Driven Payment Methods

- Payment methods depend on how banks process payments, not how they are handled in Oracle Cloud ERP.

- In India, common methods include Cheque, RTGS, NEFT, IMPS, and UPI, while in the US, Check and Wire Transfer are standard.

- The choice of payment methods is determined by banking regulations rather than client preference.

2. Seeded vs. Custom Payment Methods

- Oracle Cloud ERP provides predefined (seeded) payment methods, mainly based on the US financial system.

- Businesses can define custom payment methods as per country-specific banking standards.

3. Validation Rules for Payment Methods

- Payment methods may have bank-specific validation requirements to ensure smooth processing.

- Example: RTGS payments in India require an IFSC code; missing information can lead to bank rejections.

- Oracle Cloud ERP allows defining mandatory validation rules to prevent incomplete payments from being processed.

4. Invoice Grouping for Payments

- Payments are grouped under Payment Process Requests (PPRs) based on criteria like Supplier, Supplier Site, Currency, and Payment Method.

- Payment methods on invoices are considered for batch processing, but manual payments allow for overrides.

5. Manual Payment Method Overrides

- When processing payments via Create Payment Form, the invoice-level payment method can be overridden by the payment method specified on the payment header.

6. Payment Output Format

- The payment output format is determined by the Payment Document and Payment Process Profile, not by the payment method itself.

These configurations ensure accurate, efficient, and compliant payment processing in Oracle Financials.

Navigation to Configure Payment Methods

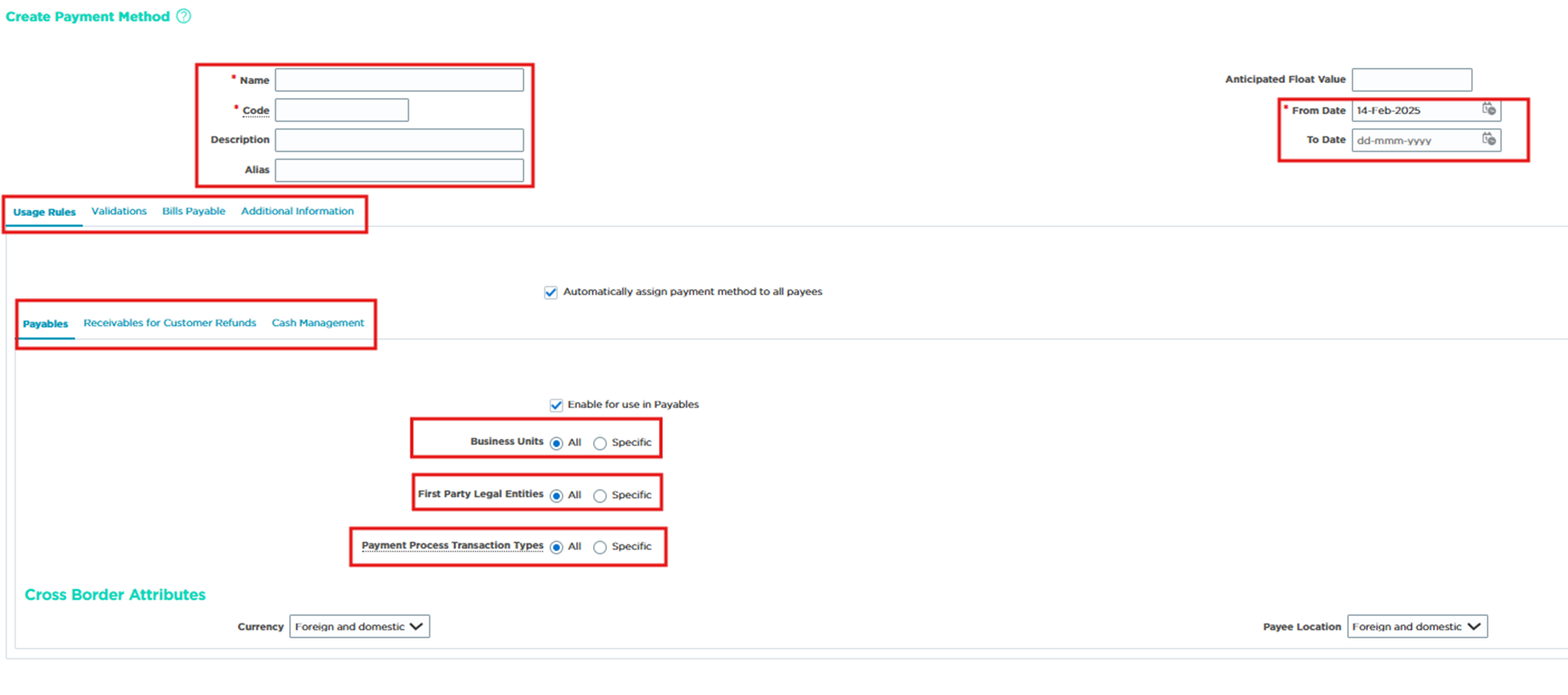

Go to Setup and Maintenance → Payables → Manage Payment Methods.

Key Fields in Payment Method Setup

- Name: The unique name assigned to the payment method.

- Code: The system-defined code for the payment method (must be in uppercase and contain no spaces).

- Description: A brief explanation of the payment method (e.g., for Bill Payable, specify its use for processing bill payments).

- Usage Rules: Defines whether the payment method applies to Payables, Receivables, or Cash Management.

- Validations: Specifies mandatory details required for processing (e.g., IFSC code for RTGS payments in India).

- Bill Payable Maturity Date: Defines the due date for bill payments.

Proper configuration ensures accurate payment processing and compliance within Oracle Financials.

Conclusion

Properly configuring payment options, procurement agents, payment terms, RDS, and payment methods is crucial for optimizing AP operations in Oracle Financials. These setups ensure seamless invoice processing, faster payments, and improved compliance.

By implementing these best practices, organizations can achieve greater financial control, reduce processing time, and enhance supplier relationships. Stay tuned for more insights on Oracle Financials!