The banking and finance industry is undergoing rapid transformation, driven by the rise of advanced technologies, evolving regulations, and shifting customer expectations. At Conneqtion, we combine our deep industry expertise with innovative, customized solutions to address the sector’s unique challenges. From enhancing operational efficiency and ensuring regulatory compliance to optimizing customer engagement and risk management, we help financial institutions adapt to the changing landscape. By integrating technologies like AI, automation, and cloud solutions, we empower banks and financial firms to remain agile, competitive, and future-ready in today’s dynamic market.

Industry Challenges

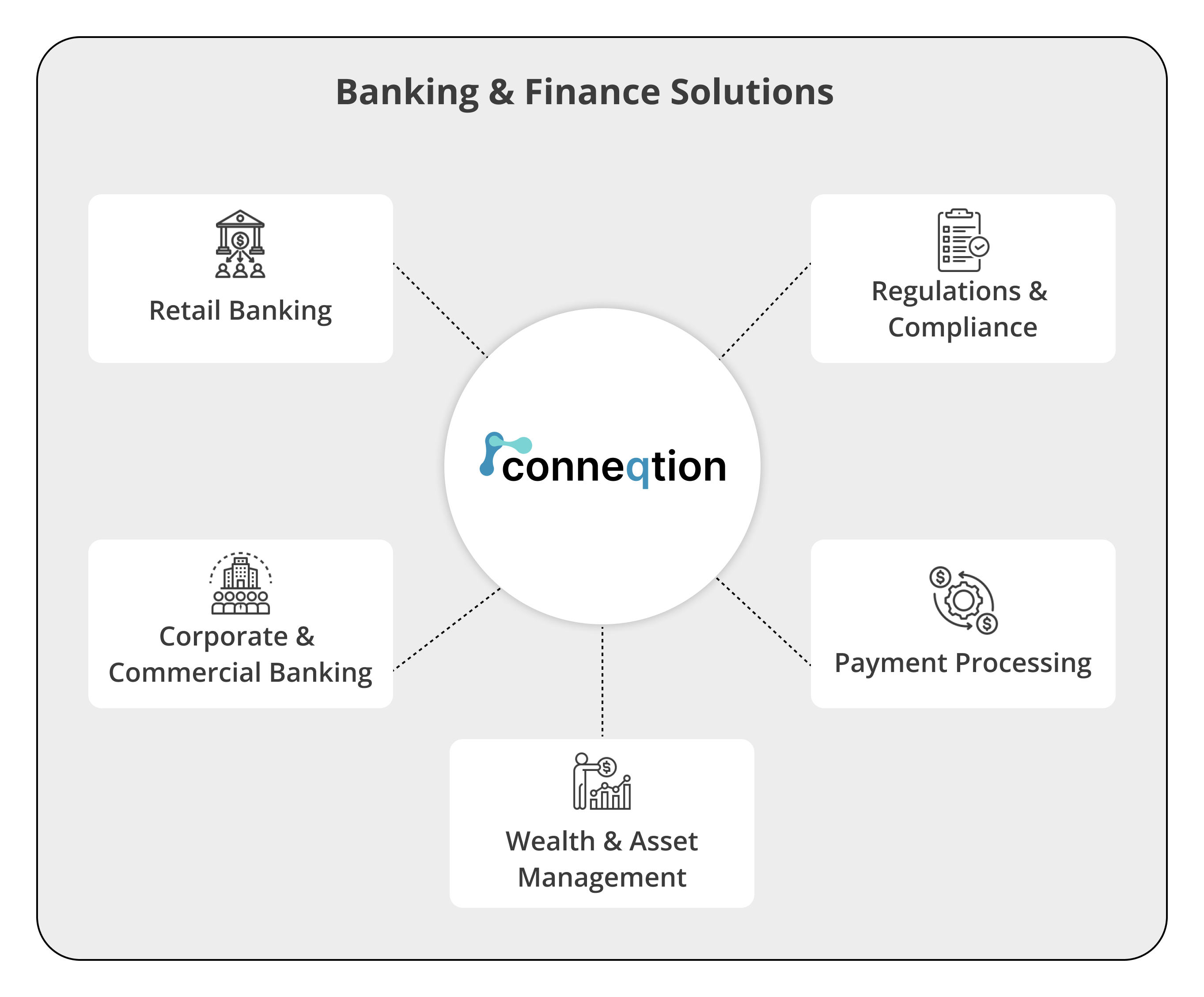

Banking & Finance Solutions by Conneqtion

At Conneqtion, we offer innovative digital solutions tailored to the banking and finance sector across five key areas:

- Retail Banking: Enhancing customer experiences with seamless digital banking, personalized services, and efficient core banking operations.

- Corporate & Commercial Banking: Streamlining large-scale transactions and optimizing cash flow with customized financial solutions.

- Wealth & Asset Management: Leveraging advanced analytics for better portfolio management and client engagement.

- Payment Processing: Implementing secure, real-time payment solutions with a focus on fraud prevention.

- Regulations & Compliance: Automating compliance processes to ensure regulatory adherence and risk mitigation.

Our expertise empowers financial institutions to stay competitive and efficient in a rapidly evolving market.

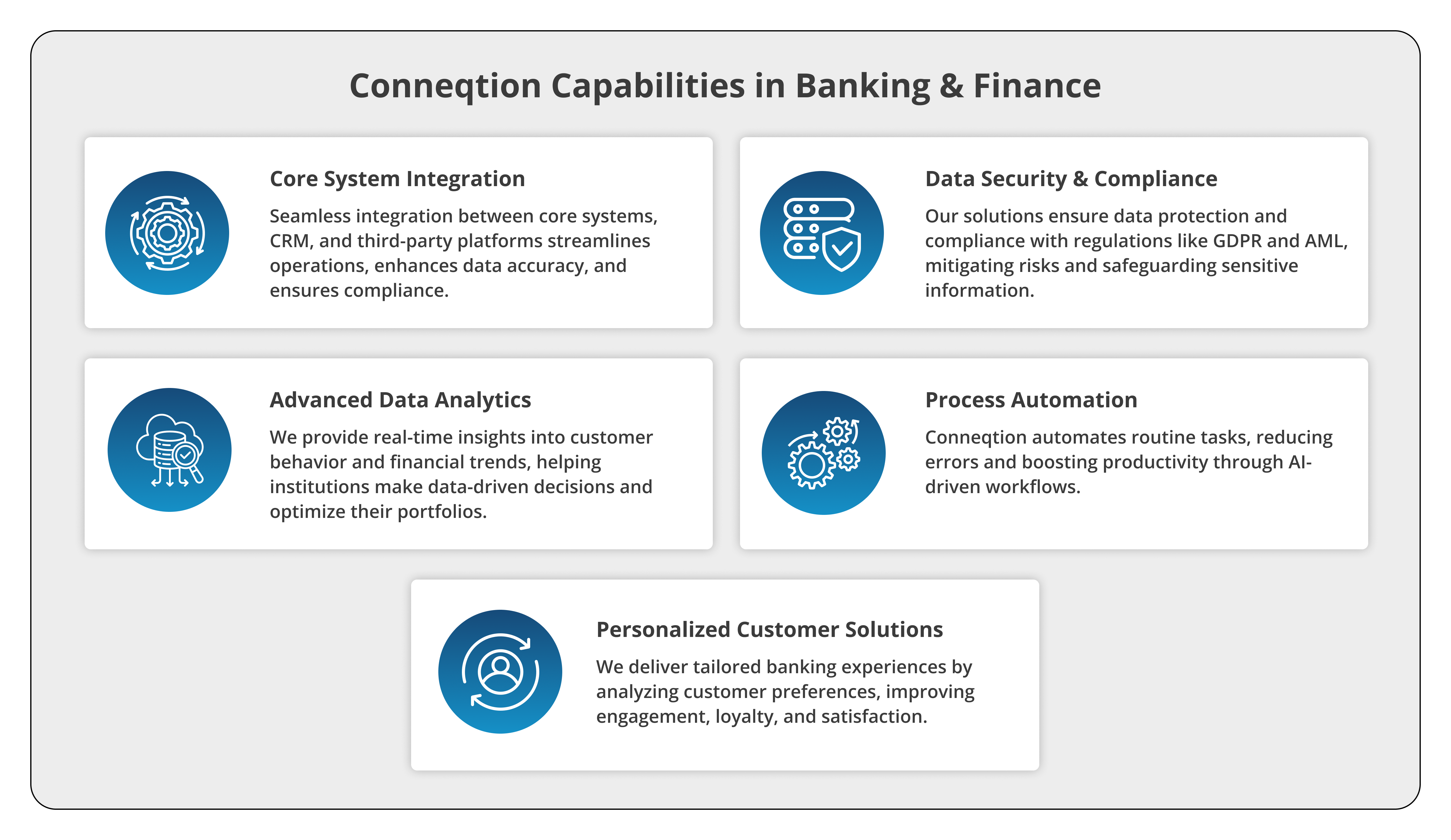

How Conneqtion Can Help in Banking & Finance?

Conneqtion’s Reporting & Analytics for Banking & Finance

Conneqtion provides tailored reporting solutions to meet the diverse needs of the banking and finance sector:

- Regulatory Compliance: Utilizing Oracle EPM to ensure adherence to financial regulations.

- Business Insights: Leveraging Oracle Analytics to guide business strategy with data-driven insights.

- Core Finance Operations: Streamlining finance operations with Oracle ERP for efficient management.

- Management Reporting: Delivering comprehensive insights and reports for efficient decision-making.

These solutions empower financial institutions with accurate, real-time insights to improve performance and compliance.

Transform your technology and revolutionize your business.

Get in touch with us today to explore how we can help drive efficiency and create value.