In this blog, we’ll walk through the fundamental steps required for setting up Accounts Payable (AP) in Oracle Financials. Whether you’re configuring a new system or refining an existing one, mastering these basic steps is crucial for ensuring smooth AP operations.

In Part 1 of this series, we’ll focus on the mandatory steps for getting started, including:

- Creating a Business Unit and assigning Business Functions.

- Managing Common Options for Procurement and Payables.

- Setting up Invoice Options.

By understanding these foundational elements, you’ll lay the groundwork for efficient AP processes that align with your organization’s financial management goals. Let’s begin.

Step 1: Create a Business Unit

Business units are meant for transactional data security.

Business case for creating BU : There are two AP managers in an organisation, Mr A is hired for Zone A and Mr B is hired for Zone B. The entity doesn’t want that Mr A should have access to the data in Zone B and similarly Mr B should not have access to data in Zone A.

Now, in such a situation, we need to create two separate Business units each for Zone A and Zone B and give access to the users according to the requirement of the entity.

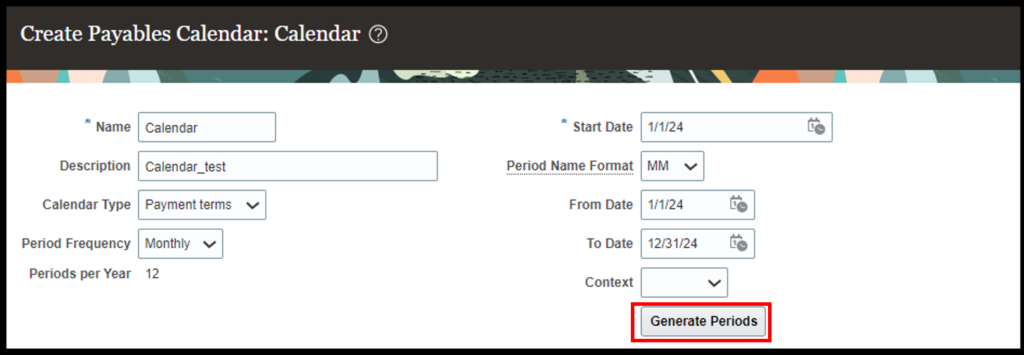

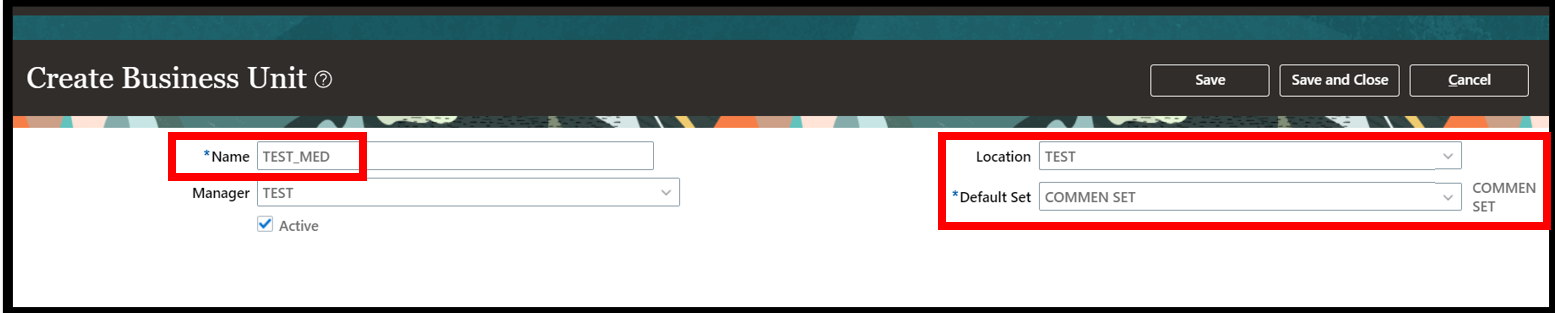

Navigation – Setup and Maintenance -> Select Offerings as Financials -> Organisational Structure -> Manage Business Unit -> Click on ‘+’ icon and create Business Unit.

Name: User needs to define a name for the Business Unit.

Manager and Location: Need to be defined in case of payroll and taxes. Else, it is not mandatory.

Default Set: It represents RDS (Reference data set.) Reference data set can be understood as the grouping of multiple business units which is then used to secure the use of some setup values such as payment terms for only those business units that are part of that group. However, as a best practice, we create a separate independent data set for every BU that we create.

Step 2: Assign Business Function to Business Unit

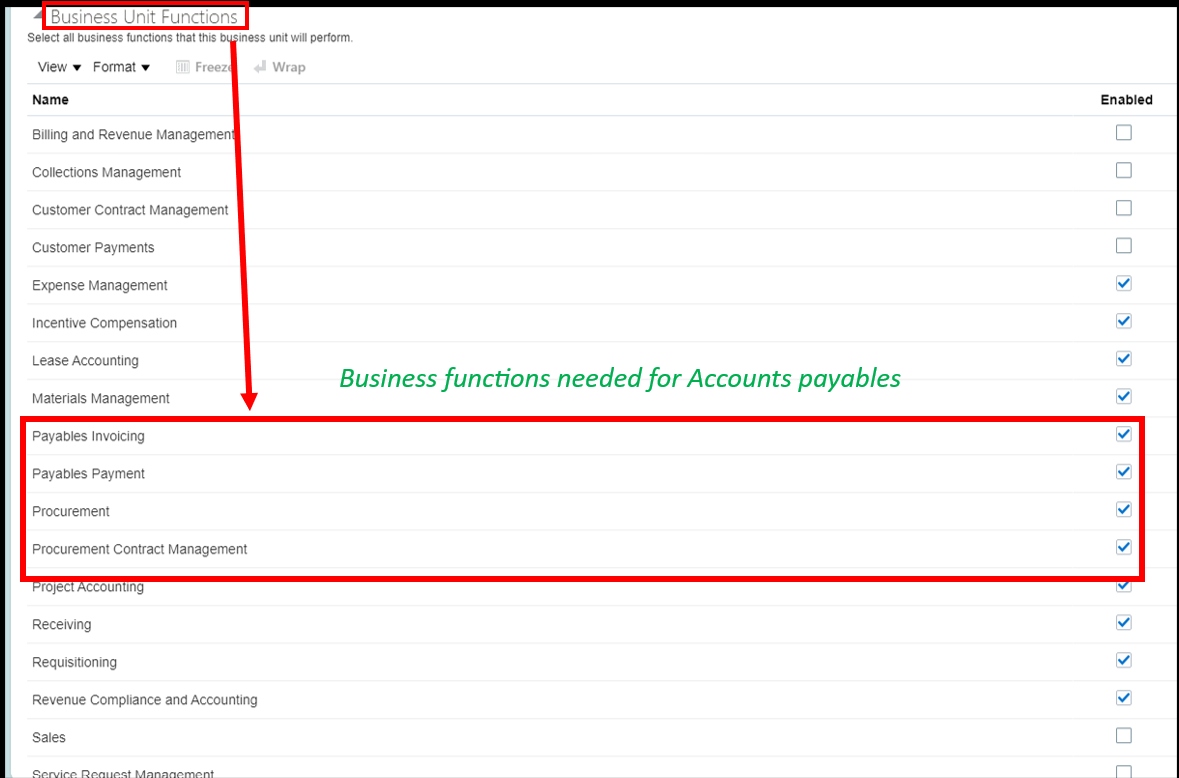

Once the business unit is created, the next step is to assign the Business function to the Business Unit being created. Here, the user will define all the functions that can be performed under the Business Unit.

Navigation – Setup and Maintenance -> offerings as financials -> organisational Structure -> Assign Business Function to Business Unit.

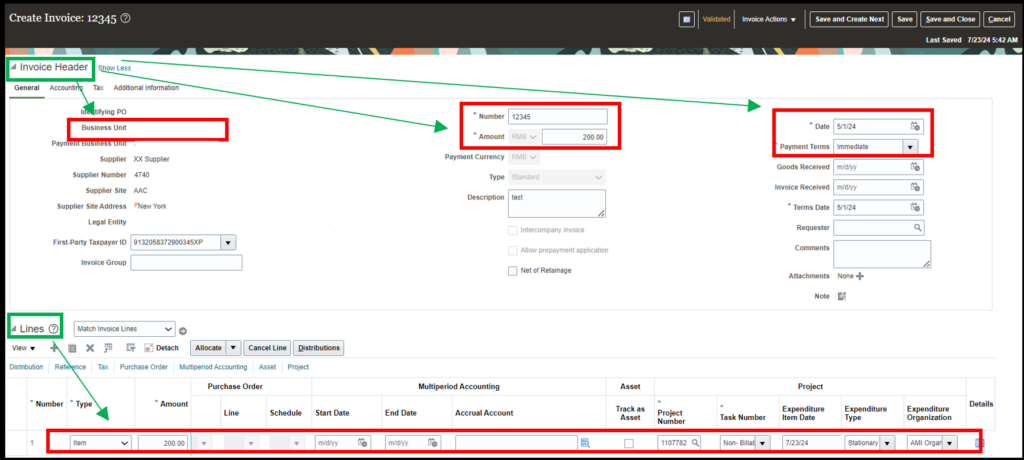

Business Unit can be created in various subledgers like Purchasing, AP, or AR. However, in this scenario since we are doing setup for AP, hence the Business Unit must be assigned functionalities relating to the Accounts Payables. This includes Payables Invoicing, Payables Payment, Procurement, Procurement Contract Management, Project Accounting and Materials Management etc.

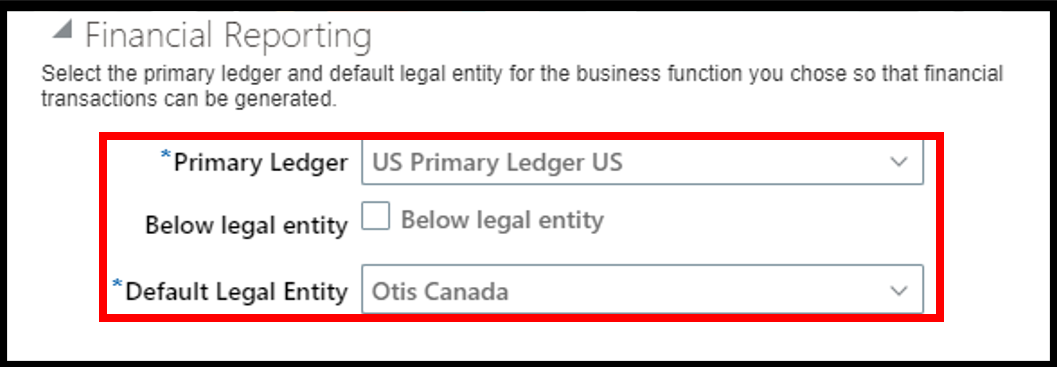

Further, the user needs to select the Financial Reporting requirements which includes selecting the Primary ledger, and the Legal entity.

Primary ledger needs to be assigned to the Business unit to let the system understand:

- The subledger (Primary ledger) will the accounting entries flow to.

- Also to make the system understand which COA structure needs to be selected for the purpose of generation of accounting entries for the subledger transactions that are entered in that specific BU.

Recommended for you: Know How To Create Recurring Invoices in Oracle Cloud Accounts Payable

Step 3: Manage Common Options for Procurement and Payables

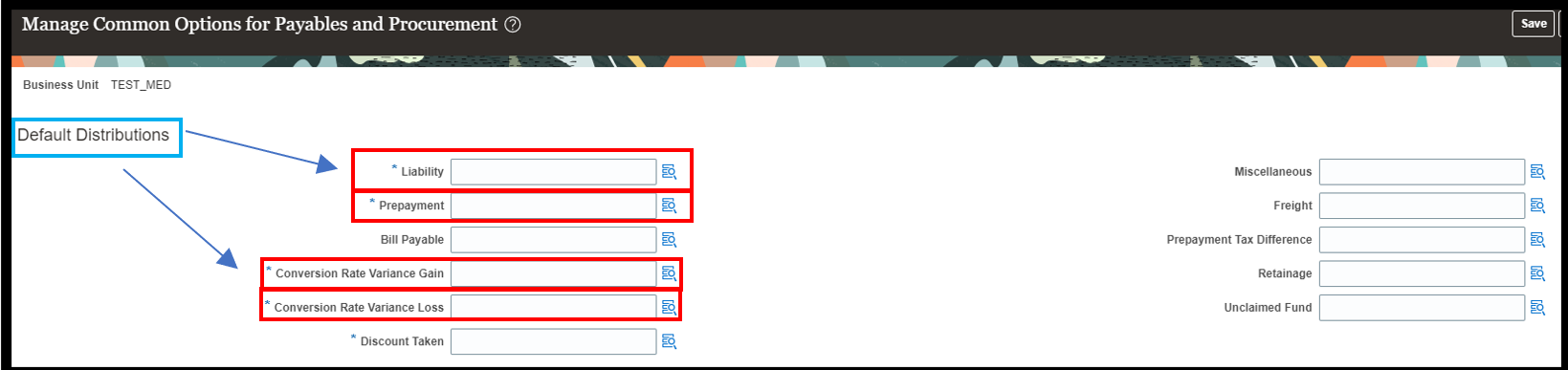

Navigation – Setup and maintenance -> Payables -> Manage Common Options for Procurement and Payables.

Under the Manage Common Options the user needs to define the accounting combinations that will be used for framing the accounting entries at the time of the creation of invoice and receipts.

Default Distributions

Liability: Although there are many suppliers that will be created in supplier master, however there will be only few suppliers’ liabilities Natural account in GL. This is because GL should contain only that detail which has to be shown in the financial statements. There is a possibility of having 3-4 bifurcations for the category of suppliers like: Government suppliers, Domestic suppliers, Trade suppliers, Regular suppliers etc. In such a scenario, we can select the most used account to be kept as default account.

Prepayment: It is the accounting combination that will be created in case there is a prepayment for the goods to the vendor.

Conversion Rate Variance Gain/Loss: In case the payment is to be made to the vendor in foreign currency and due to currency fluctuations if there is a gain, it will get credited to Conversion Rate Variance Gain. Alternatively, if there is a loss being, it will be debited to Conversion Rate Variance Loss.

These are used for the difference due to exchange rate fluctuations between the time of PO (and/or GRN) and the invoice. At the time of invoice’s accounting, if there is a difference, the resulting gain or loss account will be posted to any of these accounts.

Discount Taken: If any discount is offered by the vendor, it will get reflected in the discount taken account. Discount taken account specified here will be used on the payments accounting- where in case, if supplier has offered a cash discount (for early payment or for any other reason), then this discount account will be credited, supplier liability account will be debited, and the balance amount will be credited to cash clearing account.

Miscellaneous and Freight Account : Though not mandatory yet, if we specify the values in the “Common options for payables and procurement”, it will get reflected/defaulted at the time of filling the invoice.

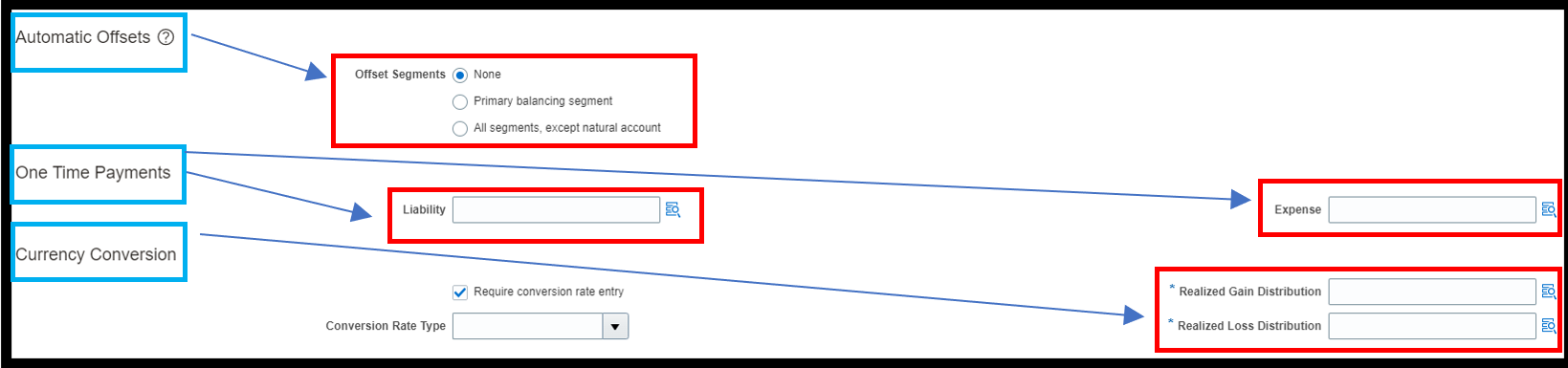

Automatic Offsets

Offset (None/Primary balancing segment/ All segment except natural account): In case of a single invoice recording, the expenses that are common for more than one Legal Entity (since the BSV’s on Expense account combinations and the liability account combination will be different), system will generate Intercompany balancing to balance such journal entries.

If, however, the organization wants that IC balancing should not be generated, but the respective legal entities’ BSV should get hit even for the liability account- in the same proportion of its expense share, then ‘Primary balancing segment’ option can be selected on this automatic offset. If IC balancing needs to be generated, then ‘NONE’ option should be selected.

| In case automatic offset is ‘NONE’, accounting entry will be: | In case automatic offset is ‘PBS’, accounting entry will be: |

| 101 Expense Dr 100 102 Expense Dr 100 TO 101 Liability A/c 200 101 ICR 100 To 102 ICP 100 | 101 Expense Dr 100 102 Expense Dr 100 TO 101 Liability 100 TO 102 Liability 100 |

One-Time Payment

Liability/ Expense Account: At times, the company needs to make a payment to a one-time supplier (with whom they are not going to deal with on a repetitive basis) and for such a situation to keep the transactions separate, the entity wants separate liability and expense account combination.

Currency conversion

Realization Gain/ Loss Distribution Account: These are also meant to record the currency fluctuations. However, in this case the currency difference from the time of invoice creation and processing payment is being recorded.

Conclusion

In conclusion, setting up Accounts Payable in Oracle Financials requires careful attention to these foundational steps. By creating and assigning the Business Unit, managing Common Options for Procurement and Payables, and configuring Invoice Options, you can establish a solid framework for your AP operations. These initial configurations ensure that your system is aligned with business requirements, streamlining invoice processing and procurement functions. In case of any assistance or further information, you can reach out to us on [email protected].