Efficient management of accounts payable is crucial for any organization’s financial well-being. This process encompasses the handling of invoices and bills, verification of their accuracy, matching them with purchase orders, and ensuring timely payment to suppliers and vendors.

In this guide, we will delve into the essential steps involved in the accounts payable invoicing process, highlighting the significance of each stage.

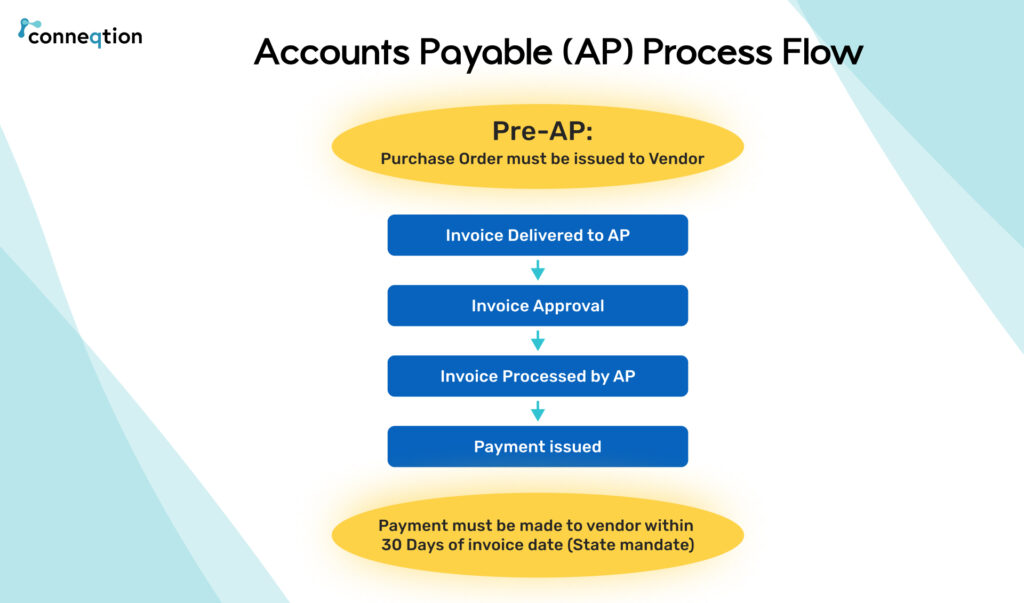

Accounts Payable Process

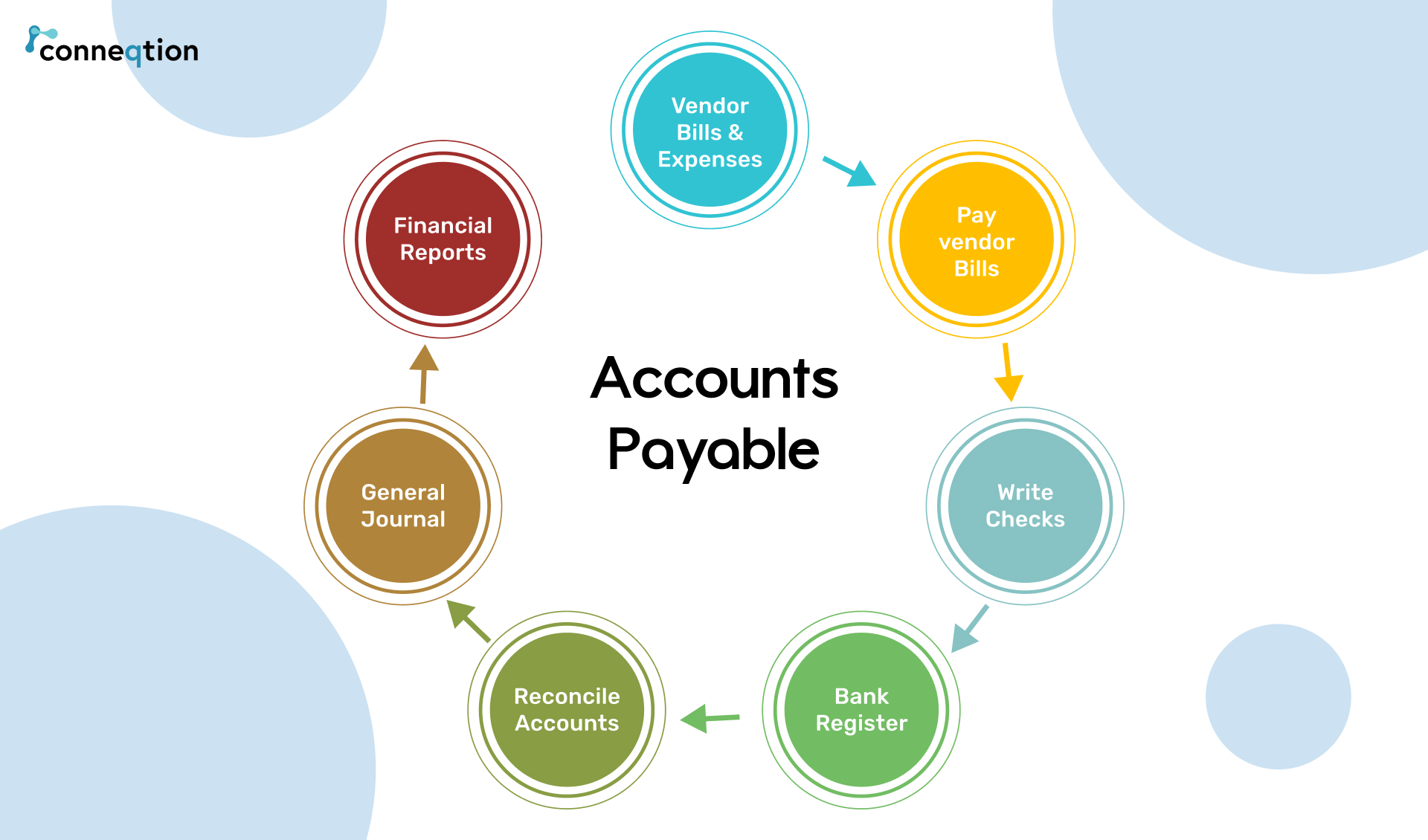

Accounts payable can be separated into three main parts, each representing a different stage or aspect of the overall process. These parts are:

- Invoice Processing

This part involves the initial receipt, verification, and recording of supplier invoices. It includes tasks such as:

- Receiving invoices through various channels (email, mail, EDI) and capturing them in the system.

- Validating the accuracy and completeness of invoices, ensuring they meet specific criteria.

- Assigning appropriate account codes and categories to invoices for proper allocation and reporting.

- Routing invoices through the necessary channels for approval, ensuring compliance with internal controls and authorization limits.

- Invoice Matching and Validation

Once invoices have been processed, this part focuses on matching them with relevant supporting documents and validating their accuracy against purchase orders and receiving information. Key activities include:

- Comparing invoices against corresponding purchase orders to ensure quantities, prices, and terms align.

- Receiving Matching: Verifying that goods or services mentioned in the invoice have been received and accepted as per the agreed terms.

- Conducting a three-way match involving the invoice, purchase order, and receiving documentation, or a two-way match between the invoice and purchase order.

- Dealing with discrepancies, resolving issues, and ensuring proper documentation and communication with suppliers.

- Payment Processing and Reconciliation

The final part of accounts payable involves the actual payment of invoices and the subsequent reconciliation of payments. It encompasses activities such as:

- Determining payment terms, such as net 30 or early payment discounts, and establishing a payment schedule.

- Creating payment batches or instructions for disbursing funds to suppliers, including checks or electronic transfers.

- Maintaining regular communication with vendors regarding payment status, resolving any payment-related inquiries or discrepancies.

- Ensuring accurate recording of payments by reconciling them with invoices and updating accounts payable records accordingly.

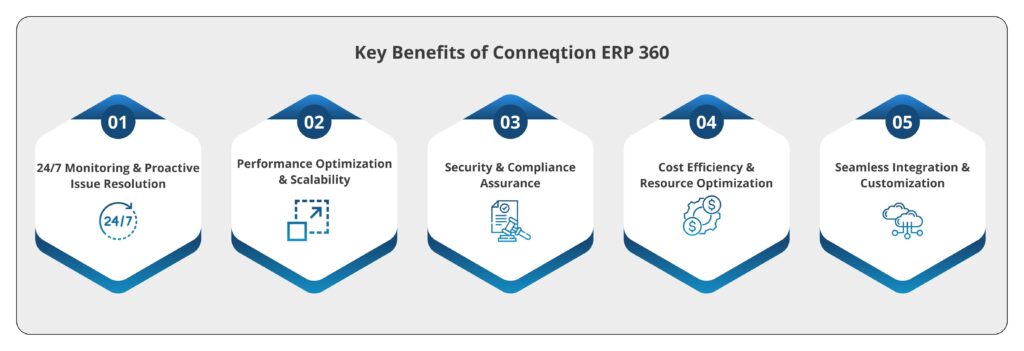

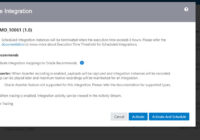

Common examples of accounts payable integrations

Integrating accounts payable with other systems, organizations can eliminate manual data entry, reduce errors, improve efficiency, and gain better visibility and control over their payables processes. These integrations help create a seamless and interconnected financial ecosystem, enabling organizations to optimize their accounts payable operations.

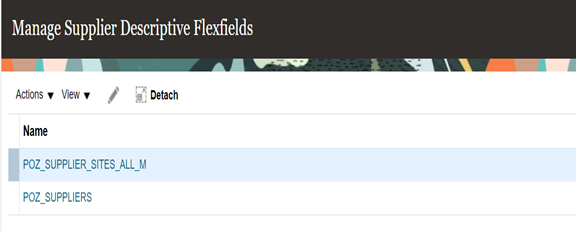

- Enterprise Resource Planning (ERP) Integration: Accounts payable systems can be integrated with an organization’s ERP system, such as SAP, Oracle, or Microsoft Dynamics. This integration allows for the seamless transfer of data between accounts payable and other modules, such as general ledger, purchasing, and inventory management.

- Purchase Order Integration: Integrating accounts payable with the purchase order system enables automatic matching of invoices with purchase orders. This integration ensures that invoices are accurately verified against the corresponding purchase orders, quantities, prices, and terms.

- Vendor Management Integration: Integrating accounts payable with vendor management systems enables easy access to vendor information, such as contact details, payment terms, and history. This integration streamlines communication with vendors and ensures accurate and up-to-date vendor data within the accounts payable system.

- Document Management Integration: Accounts payable integrations with document management systems facilitate the efficient storage and retrieval of invoice documents, supporting documentation, and payment records. This integration enables easy access to invoices and associated documents, improving productivity and ensuring compliance with record-keeping requirements.

- Payment Gateway Integration: Integrating accounts payable with payment gateways or electronic payment systems enables direct and secure electronic payment processing. This integration automates payment initiation, reconciliation, and provides real-time visibility into payment status.

- Reporting and Analytics Integration: Integrating accounts payable with reporting and analytics tools allows for the generation of comprehensive reports and analysis of accounts payable data. This integration provides insights into payment trends, vendor performance, cash flow management, and helps identify areas for process improvement and cost savings.

Also Read: Understanding Debit Memos in Oracle Financials Accounts Payable

Advanced Invoice Structure:

Invoice structure typically consists of several key components that provide important information for the buyer and seller. While there may be slight variations based on industry or legal requirements, here is a common structure for an invoice:

- Header Information:

Seller’s Information: Name, address, contact details (phone number, email, website), and tax identification number of the seller.

Buyer’s Information: Name, address, contact details of the buyer or customer.

Invoice Number: A unique identifier assigned to the invoice for tracking and reference purposes.

Invoice Date: The date when the invoice is issued.

- Invoice Details:

Description of Goods/Services: A clear and concise description of the goods or services provided.

Quantity: The quantity or units of the goods or services provided.

Unit Price: The price per unit of the goods or services.

Subtotal: The calculated total cost for each line item (quantity multiplied by the unit price).

Additional Charges: Any additional charges, such as shipping fees, taxes, or discounts.

Total Amount Due: The sum of the subtotal and additional charges, representing the total amount the buyer needs to pay.

- Payment Terms:

Payment Due Date: The date by which payment is expected from the buyer.

Payment Methods: Accepted methods of payment, such as bank transfer, credit card, or check.

Late Payment Penalties: Any penalties or interest charges applied for late payments.

- Additional Notes or Terms:

Additional information or terms, such as warranty details, return policies, or any specific contractual agreements.

Conclusion:

By effectively managing accounts payable and implementing efficient invoicing methods, businesses can optimize their financial operations, strengthen supplier relationships, and contribute to the overall success and sustainability of the organization. If you are looking for accounts payable integration, contact conneqtion group today to handle the whole invoicing integration.