Table of contents:-

- Importance of tax compliance in organizations

- How to manage tax audits with Oracle Tax?

- How does Conneqtion handle oracle tax implementation?

- The future of Oracle Tax and its potential impact on tax compliance

- Conclusion

Are you tired of the complex tax compliance processes in your business? Oracle Tax Implementation offers a solution to modernize tax compliance and automate manual tasks involved in tax management. You can configure tax codes, rules, and jurisdictions specific to your business needs, and integrate them seamlessly with other Oracle modules. Let’s explore how you can simplify tax compliance with Oracle Tax Implementation.

Importance of tax compliance in organizations

Tax compliance is a critical aspect of any organization’s financial operations. Failure to comply with tax laws and regulations can lead to severe consequences. Here are some reasons why tax compliance is essential for organizations:

Avoid legal and financial penalties: Non-compliance with tax laws and regulations can result in hefty fines, penalties, and even legal action. These consequences can have a severe impact on the financial health of the organization and its reputation.

Maintain good relations with tax authorities: Compliance with tax laws helps organizations maintain good relations with tax authorities, which can be crucial in the event of a tax audit or investigation.

Accurate financial reporting: Tax compliance requires accurate financial reporting, which can provide valuable insights into the organization’s financial performance and help identify areas for improvement.

Ensure business continuity: Failure to comply with tax laws and regulations can lead to disruptions in business operations, which can have a significant impact on the organization’s overall performance and success.

Build trust with stakeholders: Compliance with tax laws can help build trust with stakeholders, including customers, investors, and employees. This trust can contribute to the organization’s long-term success and sustainability.

How to manage tax audits with Oracle Tax?

Oracle Tax provides a range of tools and services to help manage tax audits and ensure compliance with tax laws and regulations. These can include automated tax reporting and filing, real-time tax calculations and reporting, and detailed analytics and reporting capabilities to help you better understand and manage your tax obligations. Managing tax audits with Oracle Tax involves a few key steps:

Step 1: It’s important to gather all relevant tax information and ensure that it’s accurate and up to date. This can involve reviewing your tax filings and financial records, identifying potential issues or areas of concern, and developing a plan for responding to audit requests.

Step 2: Once an audit is underway, it’s important to maintain open and regular communication with the tax authorities and any other parties involved in the process. This can involve providing requested information in a timely manner, responding to questions or concerns, and working collaboratively to resolve any issues that arise.

Step3: Throughout the audit process, it’s important to maintain detailed records of all communications, documents, and other relevant information. This can help ensure that you have a clear understanding of the audit process and any decisions or outcomes and can also help you prepare for future audits or other tax-related activities.

Step 4: Ultimately, the goal of a tax audit is to ensure that you follow all applicable tax laws and regulations. To achieve this, it’s important to work proactively to identify and address any areas of non-compliance, and to implement appropriate measures to prevent future issues.

Recommended for you: Understanding Debit Memos in Oracle Financials Accounts Payable

How does Conneqtion handle oracle tax implementation?

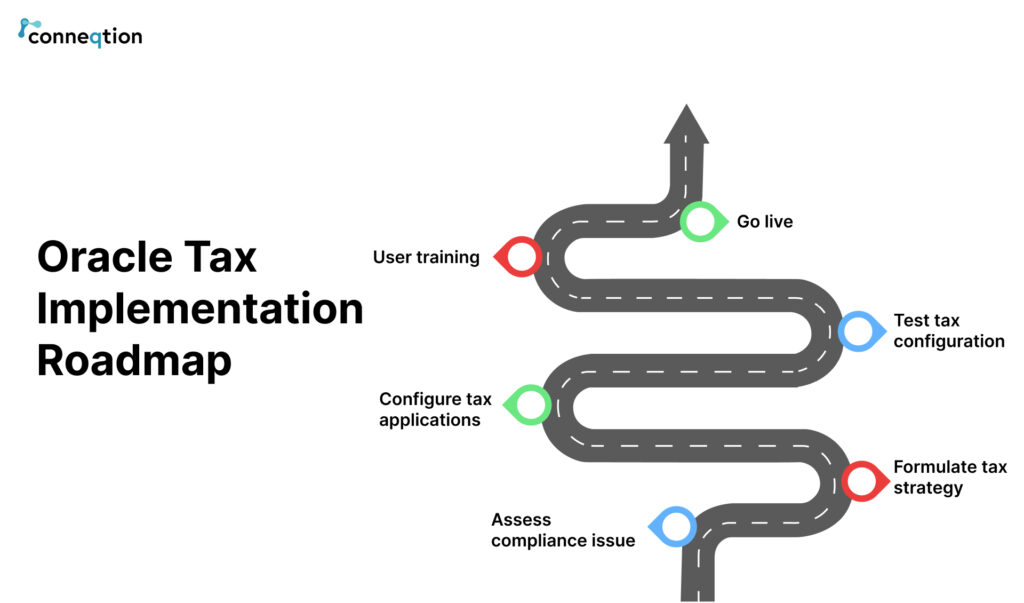

Conneqtion is an Oracle Partner and an expert in Oracle Tax implementations. We approach to implementing Oracle Tax involves the following key steps:

- Conneqtion begins by conducting a thorough analysis of the client’s tax requirements and business processes and designing a customized implementation plan based on their unique needs. This includes identifying any potential issues or areas of concern and developing strategies to mitigate these risks.

- We are experienced consultants who work closely with the client to implement Oracle Tax, including configuring the system, and integrating it with their existing systems and processes. This involves extensive testing and validation to ensure that the system is functioning correctly and meeting the client’s needs.

- We provide comprehensive training and support to help clients get the most out of Oracle Tax. This includes training on how to use the system effectively, as well as ongoing support to help clients address any issues or challenges that arise.

- Finally, Conneqtion provides ongoing maintenance and upgrades to ensure that the client’s Oracle Tax implementation remains up-to-date and compliant with the latest tax laws and regulations.

The future of Oracle Tax and its potential impact on tax compliance

As businesses seek to navigate an increasingly complex and demanding tax compliance landscape.

- Integration with Emerging Technologies: As new technologies such as AI and blockchain continue to evolve, there is significant potential for these tools to transform the tax compliance landscape. Oracle Tax is likely to play a key role in this transformation, with its ability to integrate with a wide range of emerging technologies and provide advanced analytics and reporting capabilities.

- Greater Regulatory Scrutiny: As governments around the world continue to focus on tax compliance, there is likely to be greater regulatory scrutiny and enforcement in this area. Oracle Tax is well-equipped to help businesses meet these compliance requirements, with advanced reporting and analytics capabilities that can help identify and address potential areas of non-compliance.

Conclusion

Oracle Tax Implementation offers a comprehensive suite of tools and features that can help businesses achieve their compliance objectives and optimize their tax performance. By leveraging the power of Oracle Tax Implementation, businesses can reduce the burden of tax compliance and focus on their core operations and growth strategies. In oracle tax implementation Conneqtion has years of experience and expertise in it. Hire us today to get started…